-

$130M+

Capital Raised

-

30+

Completed Projects

-

18%

Average IRR

Our Track Record

Arya + Rasamallu is a real estate investments and development firm focused on commercial triple-net (NNN) properties, multifamily value-add communities, and select land or mixed-use projects. With over 15 years of experience and more than $130M executed across U.S. growth markets, we deliver disciplined underwriting, hands-on execution, and investor-aligned returns

Our Focus

- Triple-Net Commercial Assets (Retail, Medical, Education)

- NNN Commercial Assets

- Multifamily Value-Add Acquisitions

- Land Development & Mixed-Use Projects

Mission

- To generate consistent, risk-adjusted returns for investors through disciplined acquisition, operational excellence, and transparency.

| Firm Performance Overview | Performance Benchmarks |

|---|---|

| $150M+ total assets under management (AUM) | IRR: 16% (Proforma) → 18.5% (Achieved) |

| $50M+ equity raised across syndications | ARR: 18% (Proforma) → 20.2% (Achieved) |

| 25+ successful projects completed across Texas & the Southeast | CoC: 7% (Proforma) → 8.5% (Achieved) |

| 100+ active investors and strategic partners | |

| 18.5%+ average annualized investor returns since inception |

Commercial (NNN)

Acquire long-term NNN leased properties for stable, predictable income with minimal operational risk.

Multifamily Value-Add

Acquire underperforming assets, implement capital improvements, increase NOI, and refinance or sell for appreciation.

Land & Mixed-Use Development

Strategic land acquisitions for future multifamily, retail, or institutional development.

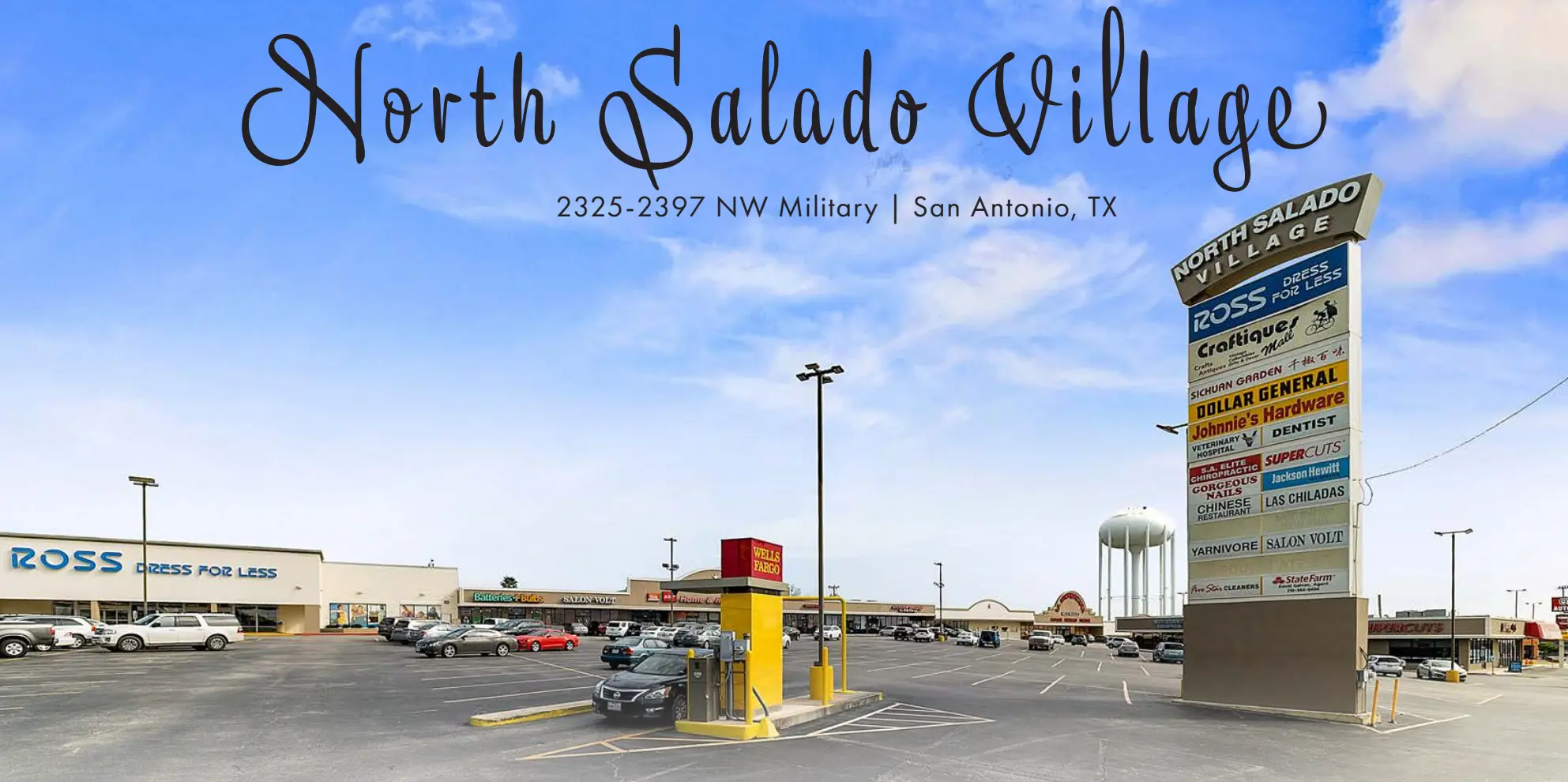

North Salado Village — $18.5M

-

ARR: 23.1%

-

EM: 1.9x

-

CoC: 10%

Acquired via 1031 exchange, this stabilized retail center features long-term leases with Ross and Dollar General. Located in a dense trade area, it delivers steady cash flow with low tenant rollover and high visibility on a major commercial corridor.

Camino Bandera Plaza — $10M

-

ARR: 18.1%

-

EM: 1.9X

-

CoC: 10%

A 30,000 SF multi-tenant retail development completed in 2022. Anchored by PJ’s Coffee, State Farm, and Wei Chow, the center sits along Loop 1604 with traffic counts exceeding 45,000 VPD. Fully leased with high-credit tenants and strong stabilized returns.

Culebra Land Development — $15.5M

30-acre land development near Loop 1604 & Culebra Rd. Project included major infrastructure improvements—roads, flood control, and utilities—sold to a national multifamily REIT. Delivered 3x equity multiple, showcasing Arya’s development and entitlement expertise.

San Pedro Towne Center — $12M

-

ARR: 20%

-

EM: 2x

-

CoC: 10%

A 100,836 SF Class A retail asset in North Central San Antonio. Anchored by Crunch Fitness, Dollar Tree, and Conviva Care, with 93% occupancy and targeted renovations to enhance NOI growth and value. Positioned near major employment and residential corridors.

Valley Crossing — $18.3M

-

ARR: 20%+

-

EM: 2x

-

CoC: 7–9%

A 178,594 SF institutional-grade retail asset located in the Rio Grande Valley. Anchored by JCPenney, TJ Maxx, Petco, and Academy Sports. 97% leased and generating consistent quarterly distributions, with high tenant retention and long-term upside potential.

Bandera Plaza Retail & Mixed-Use Development — $14M (Projected, In Progress)

acquired a four-acre site at 8682 Bandera Rd, San Antonio, TX, for a planned mixed-use development featuring multi-tenant retail space and a gated townhome community. Currently in the planning and pre-development phase, the project is designed to blend stable retail income with residential appreciation potential in one of San Antonio’s fastest-growing corridors.

-

6.5% – 8%

Preferred Return

-

18%

Target IRR

-

1.8x – 2.2x

Target Equity Multiple

-

5 – 7 years

Hold Period

-

Focus

Value-add retail,mixed-use, and land development

Depreciation (27.5 yr)

A $5 M asset can deduct $182 K/year (5 M÷ 27.5) as a non-cash expense, directly lowering taxable income while preserving cash flow.

Cost Segregation (5–15 yr)

By reclassifying $1.5 M of appliances and fixtures into shorter lives (e.g., 7 yr), you accelerate $214 K/year in depreciation- roughly $160 K more than straight-line.

1031 Exchange Deferral

Roll $1 M+ of sale proceeds into a like- kind property within 45/180 days to indefinitely defer federal capital gains (15- 20% plus NIIT).

Proprietary Deal Flow

Off-market and early-look opportunities in growth corridors, driven by demographic/migration screens and broker/operator relationships.

Dual-Engine Returns

Stabilized triple-net commercial cash flow + Multifamily value add (NOI growth) = balanced income today with appreciation tomorrow.

Integrated Execution

In-house/closely managed property ops, capex, and re tenanting to cut friction, reduce OpEx, and accelerate stabilization.

Disciplined, Transparent Structures

Clear waterfalls (e.g., pref + 80/20 splits), conservative leverage, stress-tested underwriting, and GP co investment.

Integrated Execution

Real-time portal, quarterly reporting & distributions, secure docs, K-1s; cost-seg/1031 optionality for tax-efficient outcomes.

Flexible Capital Stack

Syndications that accommodate cash, SD IRAs/401(k)s, trusts, and entities—widening access for passive investors.

With over 15 years of combined experience, Arya and its principals have successfully executed over $60M in real estate transactions across multiple U.S. markets.

-

01 Source & Underwrite

Identify undervalued multifamily and commercial assets in high growth corridors using demographic, rent-gap, and operational metrics. Apply disciplined underwriting to select only projects with measurable upside potential

-

02 Capitalize & Acquire

Raise equity through 506(b) syndication with GP co investment and conservative leverage (60–65% LTV). Structure preferred returns and profit-sharing alignment.

-

03 Execute & Stabilize

Leverage in-house operations and targeted renovations ($5K–$15K/unit) to boost occupancy, rents, and NOI within 12–18 months. For commercial assets, focus on lease optimization, tenant mix improvements, and capital upgrades to enhance stability and foot traffic

-

04 Exit & Distribute

Refinance or sell stabilized assets (target DSCR > 1.25×, 90%+ occupancy) to return capital. Distribute 8% preferred returns, quarterly cash flow, and profit waterfall upside

- Population & Migration Trends

- Supply vs. New Construction Constraints

- Regulatory & Landlord Friendly Jurisdictions

- Job Growth & Economic Diversity

- Operational Inefficiencies

- Timing & Execution Alignment

- Rent Gap / Value Opportunity

- Owner Motivation / Distress

-

01

Qualification

Pre-screening under 506(b) guidelines

-

02

Subscription

PPM & investment

agreement -

03

Funding

Wire Capital to project

escrow -

04

Ownership

LP shares issued,portal access provided

-

05

Distribution

Quarterly Cash flow & annual reports

- $498 billion in total CRE transactions were recorded in 2024, a 16% increase from 2023, signaling renewed investor confidence.

- Occupancy rates remain above 96%, supported by long-term leases (10–20 years) and credit tenants (national chains, healthcare, and QSR).

- NNN leases often include 2–3% annual rent escalations, providing built-in inflation protection.

- 21.6 million multifamily renter households in 2023; multifamily now represents ~47.5% of rented households, with household formation outpacing housing supply by ~3.5 million units over the last decade.

- Domestic migration inflows

- concentrated in growth markets

- Texas +85,267, North Carolina +82,288, South

- Carolina +68,043, Florida ≈+64,000, Tennessee ≈+48,000.

- Owning a starter home is roughly 35% more expensive than renting, and in nearly 90% of U.S. counties, renting is more affordable than buying

Regulation D 506(b) Offering

A private placement structure allowing Arya to raise capital from accredited investors and select non-accredited investors with prior relationships, without public solicitation.

Key Highlights

- Unlimited capital raise potential

- Investor protection via transparent PPM & audited financials

- Tax efficiency (cost segregation, 1031 exchange options)