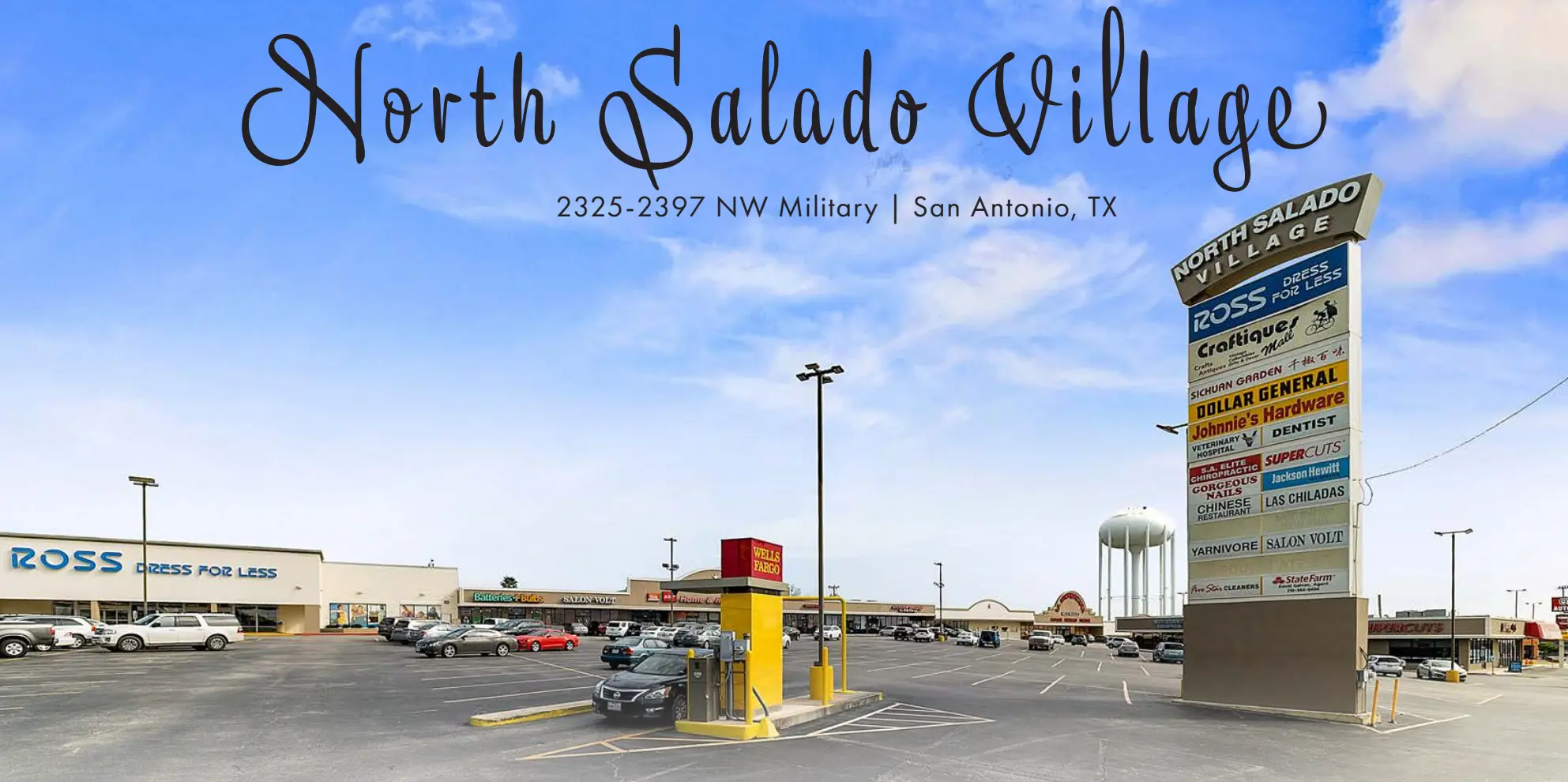

North Salado Village — $18.5M

-

ARR: 23.1%

-

EM: 1.9x

-

CoC: 10%

Acquired via 1031 exchange, this stabilized retail center features long-term leases with Ross and Dollar General. Located in a dense trade area, it delivers steady cash flow with low tenant rollover and high visibility on a major commercial corridor.

Camino Bandera Plaza — $10M

-

ARR: 18.1%

-

EM: 1.9X

-

CoC: 10%

A 30,000 SF multi-tenant retail development completed in 2022. Anchored by PJ’s Coffee, State Farm, and Wei Chow, the center sits along Loop 1604 with traffic counts exceeding 45,000 VPD. Fully leased with high-credit tenants and strong stabilized returns.

Culebra Land Development — $15.5M

30-acre land development near Loop 1604 & Culebra Rd. Project included major infrastructure improvements—roads, flood control, and utilities—sold to a national multifamily REIT. Delivered 3x equity multiple, showcasing Arya’s development and entitlement expertise.

San Pedro Towne Center — $12M

-

ARR: 20%

-

EM: 2x

-

CoC: 10%

A 100,836 SF Class A retail asset in North Central San Antonio. Anchored by Crunch Fitness, Dollar Tree, and Conviva Care, with 93% occupancy and targeted renovations to enhance NOI growth and value. Positioned near major employment and residential corridors.

Valley Crossing — $18.3M

-

ARR: 20%+

-

EM: 2x

-

CoC: 7–9%

A 178,594 SF institutional-grade retail asset located in the Rio Grande Valley. Anchored by JCPenney, TJ Maxx, Petco, and Academy Sports. 97% leased and generating consistent quarterly distributions, with high tenant retention and long-term upside potential.

Bandera Plaza Retail & Mixed-Use Development — $14M (Projected, In Progress)

acquired a four-acre site at 8682 Bandera Rd, San Antonio, TX, for a planned mixed-use development featuring multi-tenant retail space and a gated townhome community. Currently in the planning and pre-development phase, the project is designed to blend stable retail income with residential appreciation potential in one of San Antonio’s fastest-growing corridors.